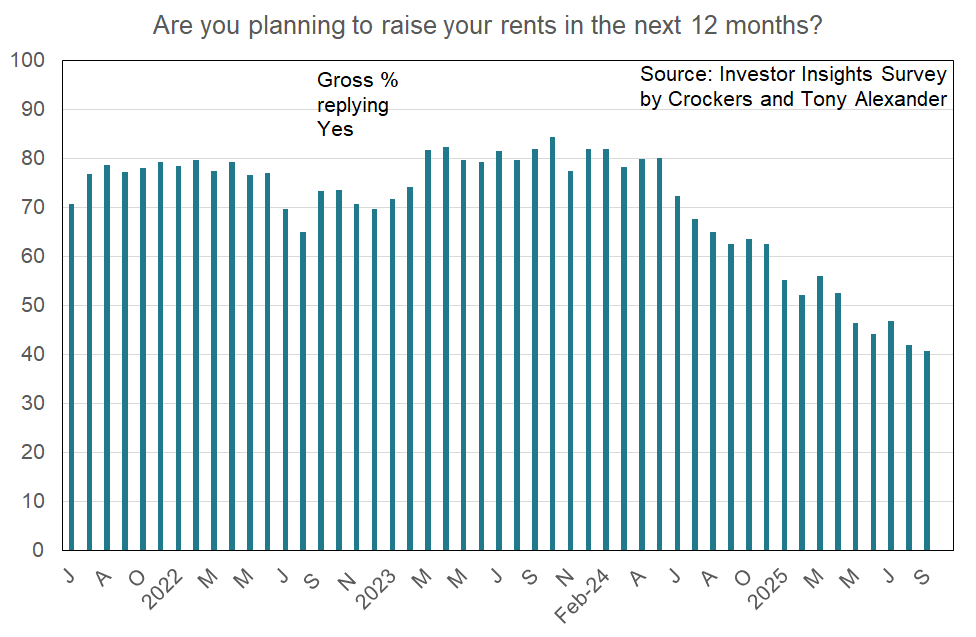

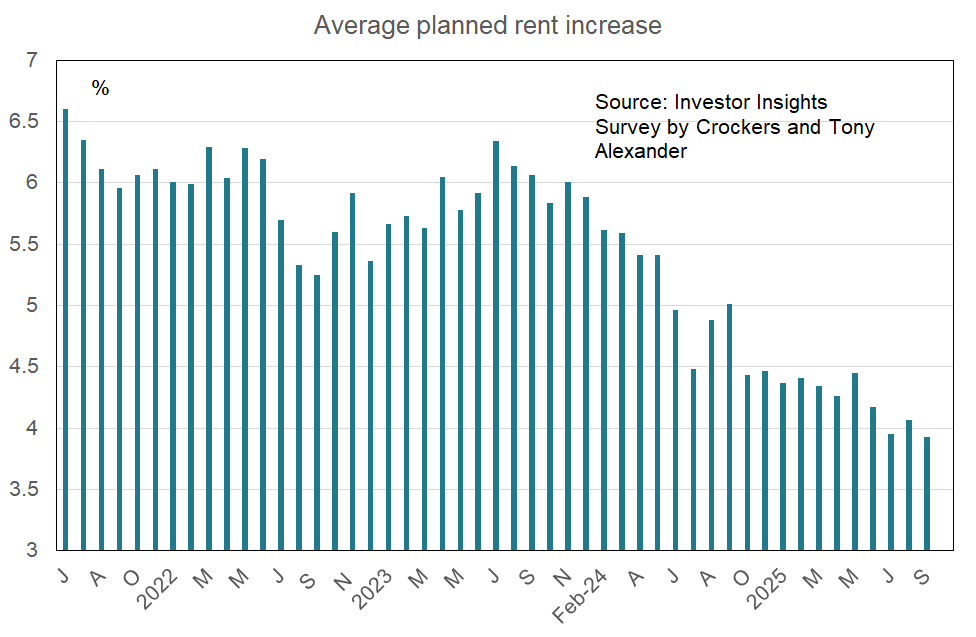

Rent increases slowing down

Welcome to the latest monthly Investor Insight survey compiled by Crockers Property Management and Tony Alexander. Each month we survey a selection of the many thousands of residential property investors on our databases with a view to gauging how things are changing over time across a wide range of indicators.

For instance, we will track changes in pressures on rents, points of particular concern, and plans regarding property purchases and intentions to sell.

Key points of interest from this month’s survey, which received 259 responses include the following.

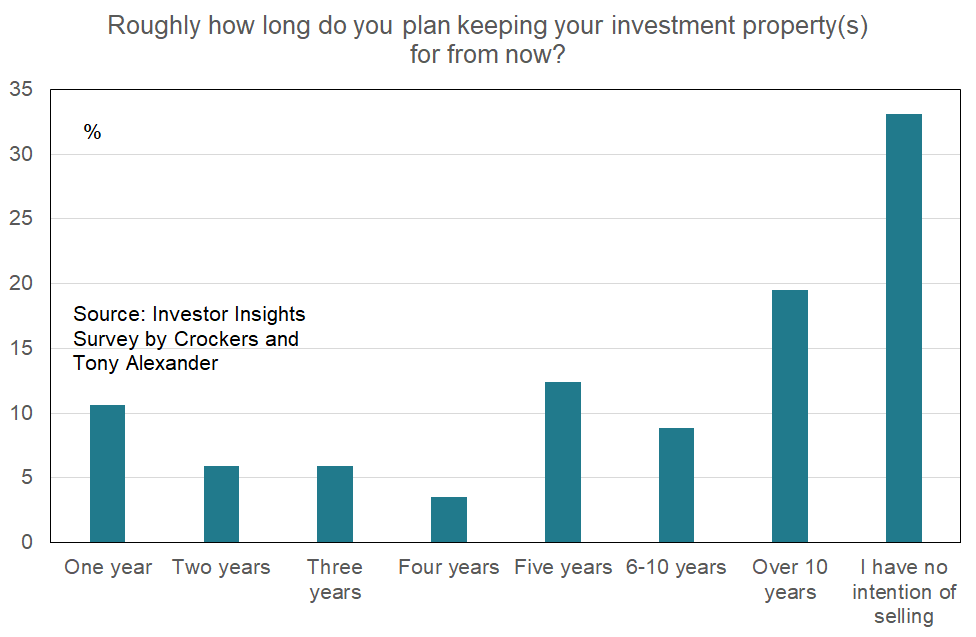

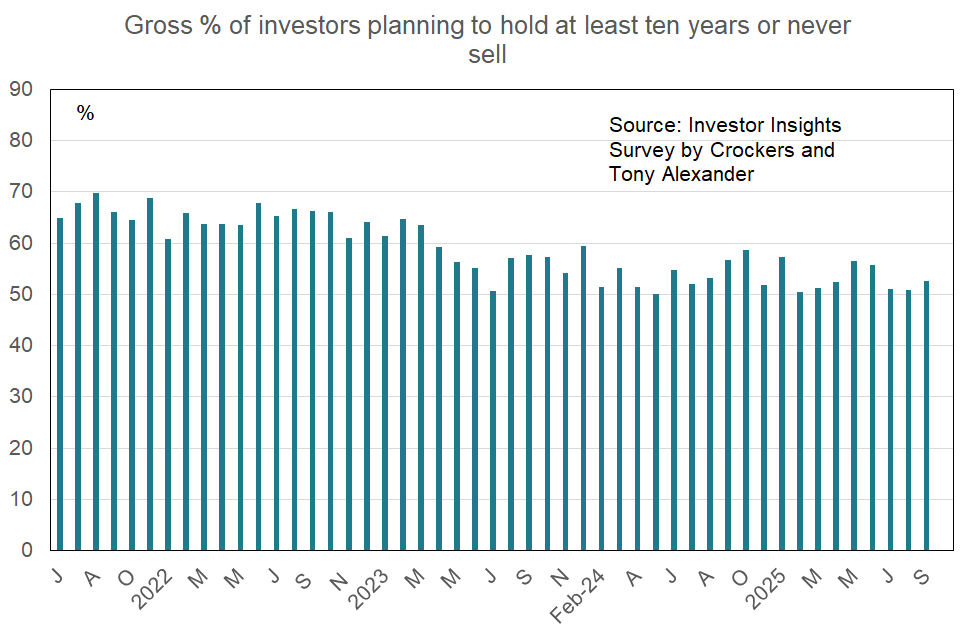

- Over half of landlords say they plan holding their property for at least ten years or never selling it.

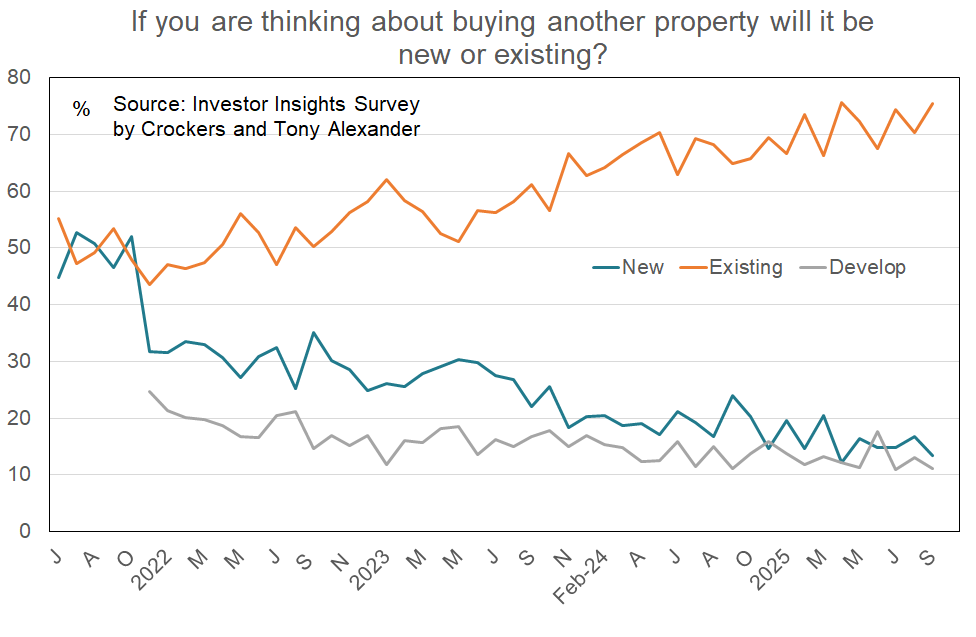

- Investors looking to make another purchase remain strongly focused on existing dwellings rather than new ones.

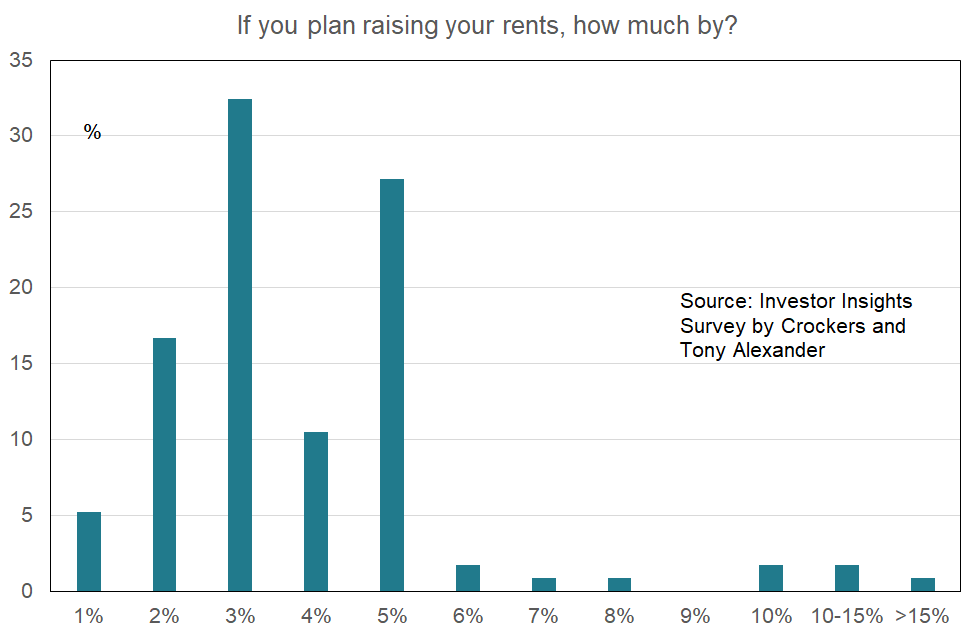

- The average rent rise which landlords will attempt to achieve over the coming year is on a downward trend.

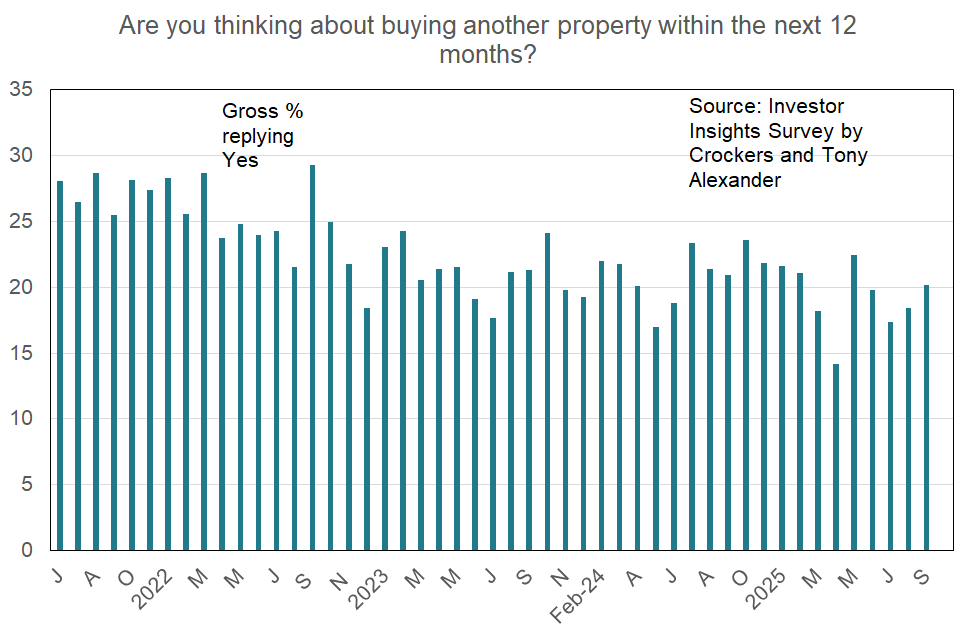

ARE YOU THINKING ABOUT BUYING ANOTHER PROPERTY WITHIN THE NEXT 12 MONTHS?

For the second month in a row there has been an improvement registered in the proportion of landlords indicating that they are thinking about buying another property in the next 12 months. The latest reading is 20% from 18% in August, 17% in July, and just 14% in April.

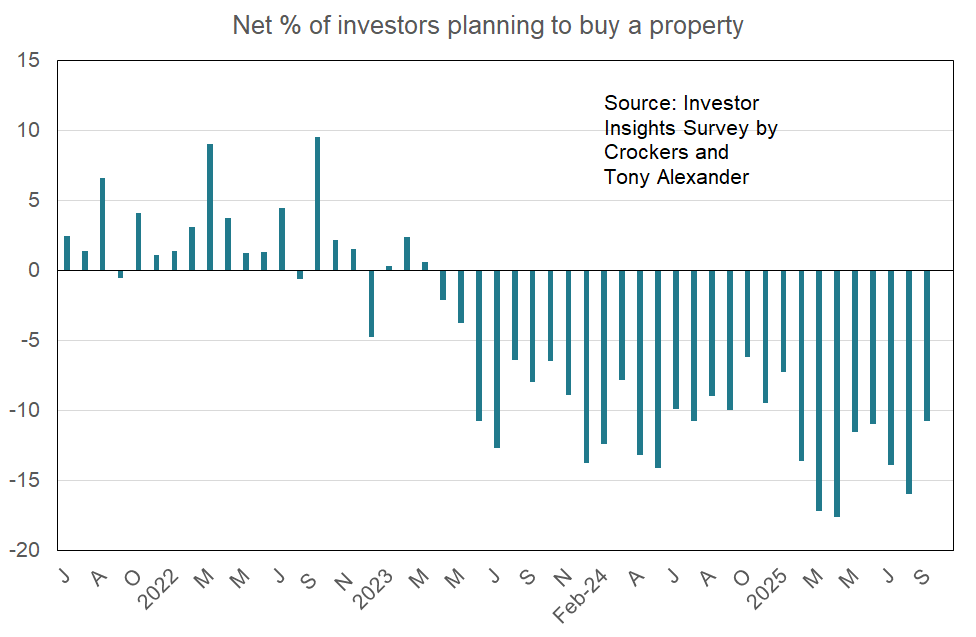

In April and May many measures in the five surveys which I run each month hit low levels and this tells us, along with the recently reported 0.9% contraction in the economy over the June quarter, that we are now on a slow improving track of recovery.

At 20% the proportion of landlords looking to buy is the best since June and that perhaps gives better perspective to the recovery since April. That is, the upward trend is very small.