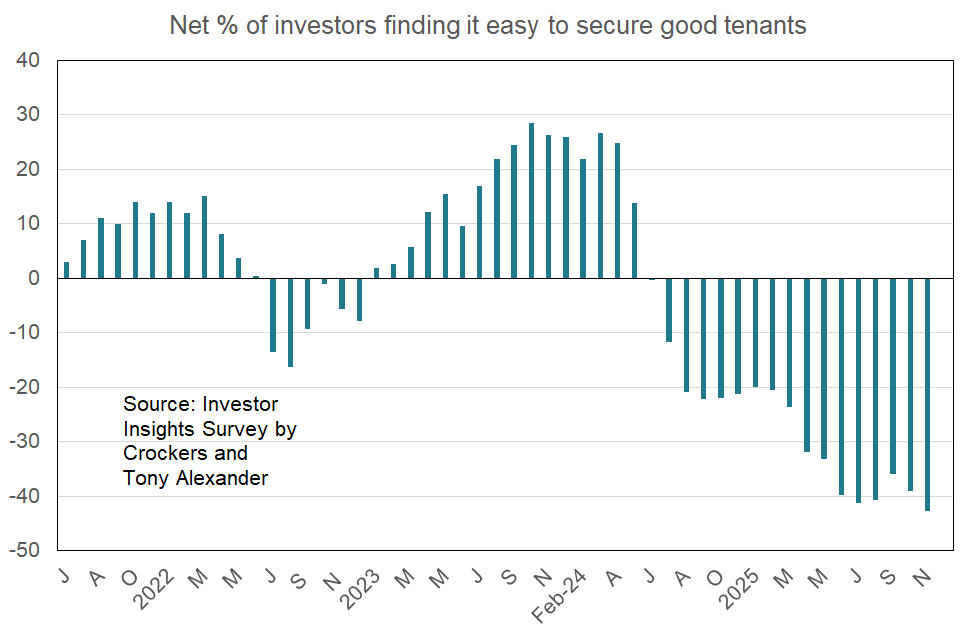

Tenants in Short Supply

Welcome to the latest monthly Investor Insight survey compiled by Crockers Property Management and Tony Alexander. Each month we survey a selection of the many thousands of residential property investors on our databases with a view to gauging how things are changing over time across a wide range of indicators.

For instance, we will track changes in pressures on rents, points of particular concern, and plans regarding property purchases and intentions to sell.

Key points of interest from this month’s survey, which received 285 responses include the following.

- Tenant availability has become even poorer with a record net 43% of landlords saying they are finding it difficult to secure a good tenant.

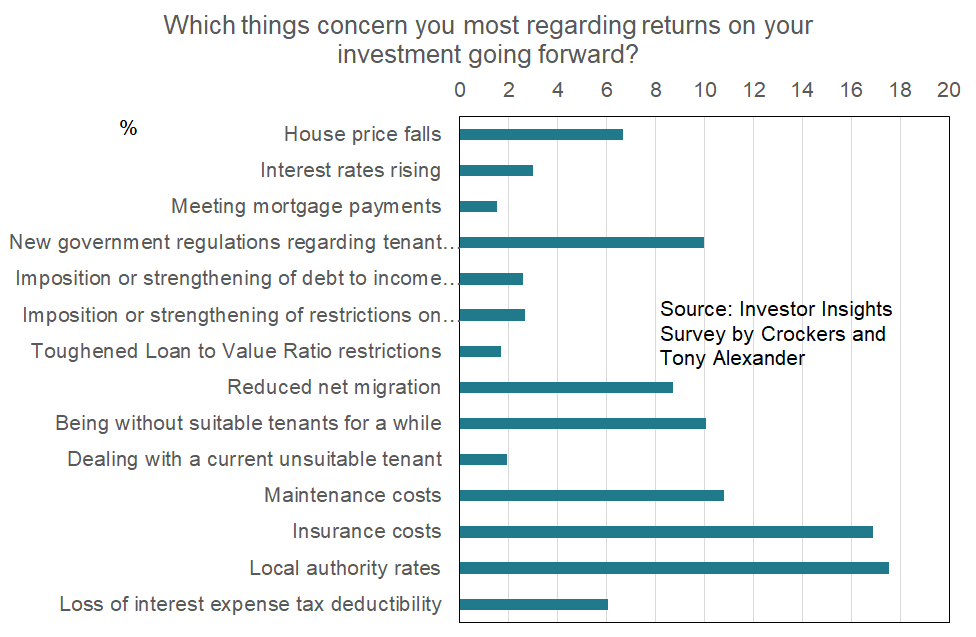

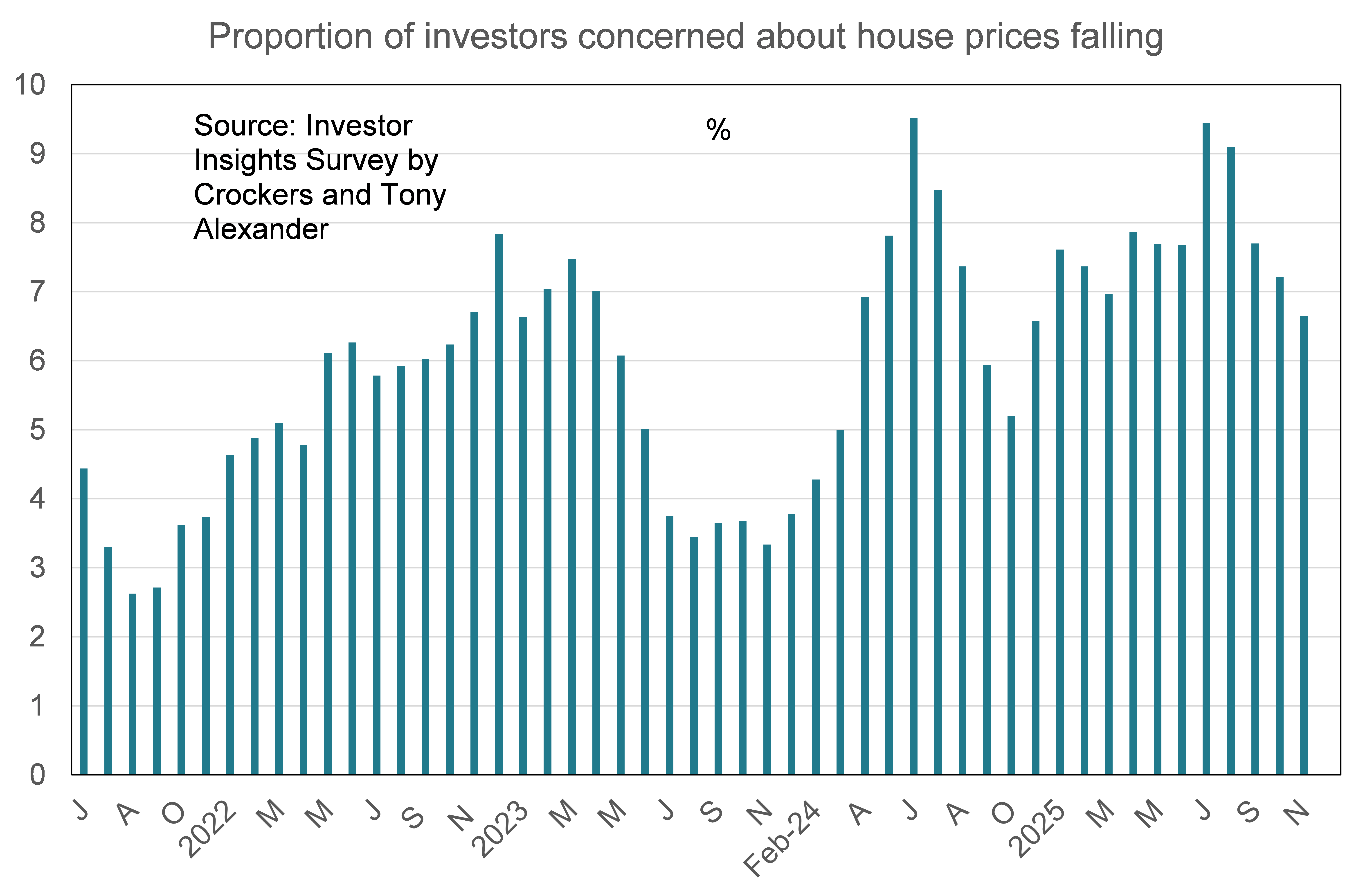

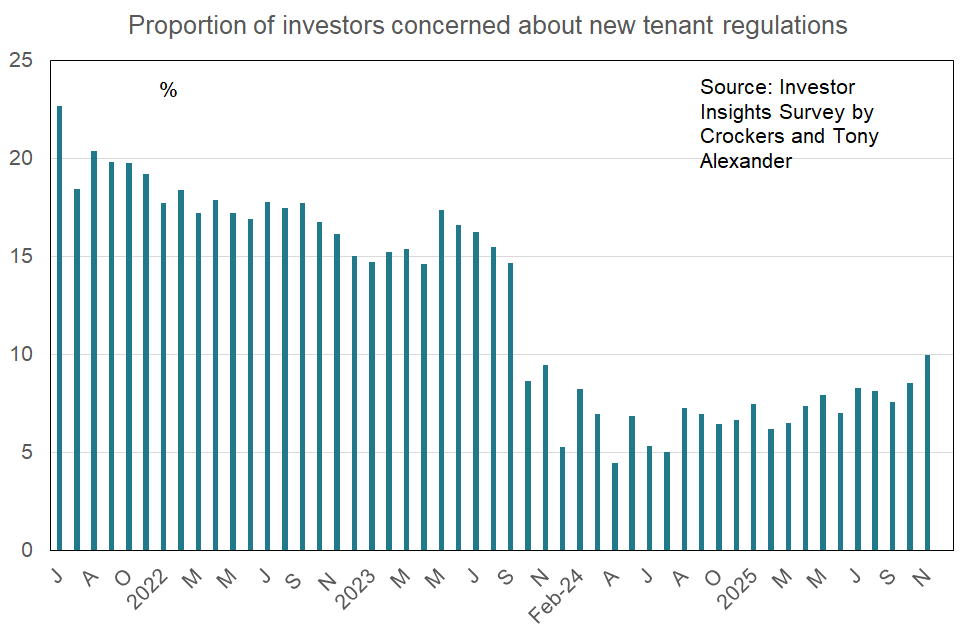

- Landlords are becoming less worried that house prices may be falling but more worried about potential changes in tenant legislation.

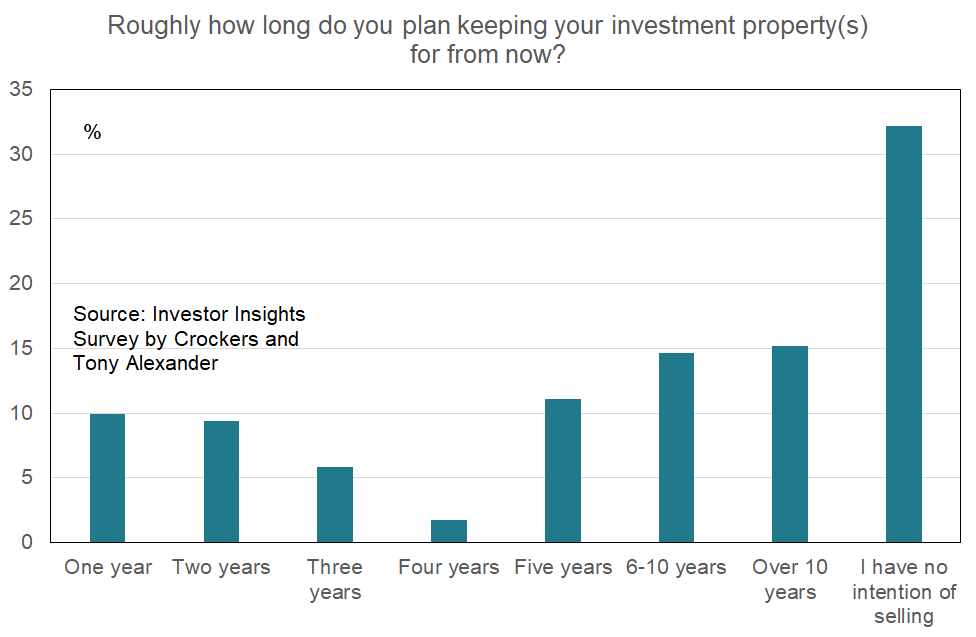

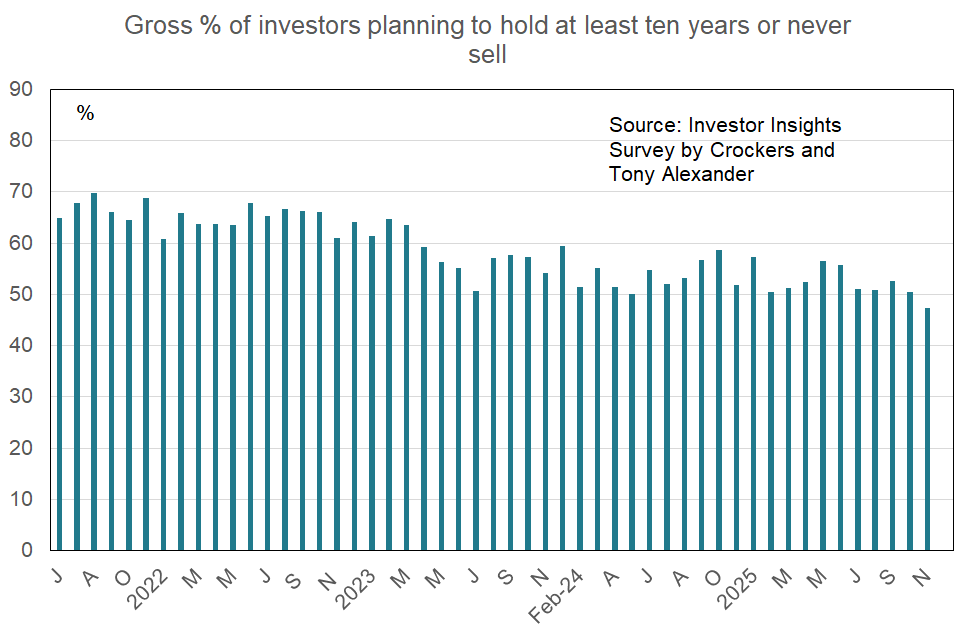

- Fewer investors are planning to hold their properties for at least ten years or never to sell.

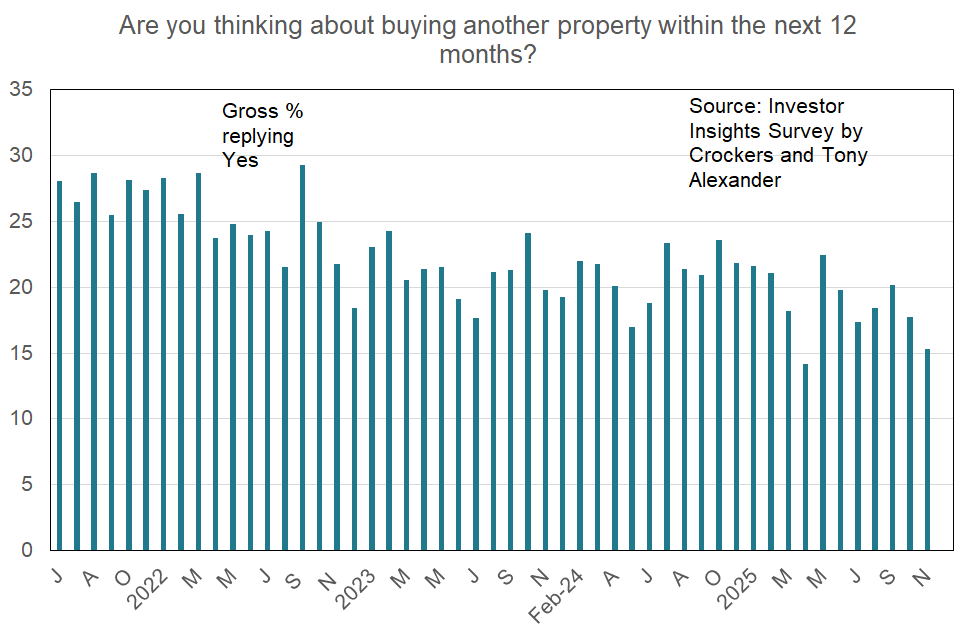

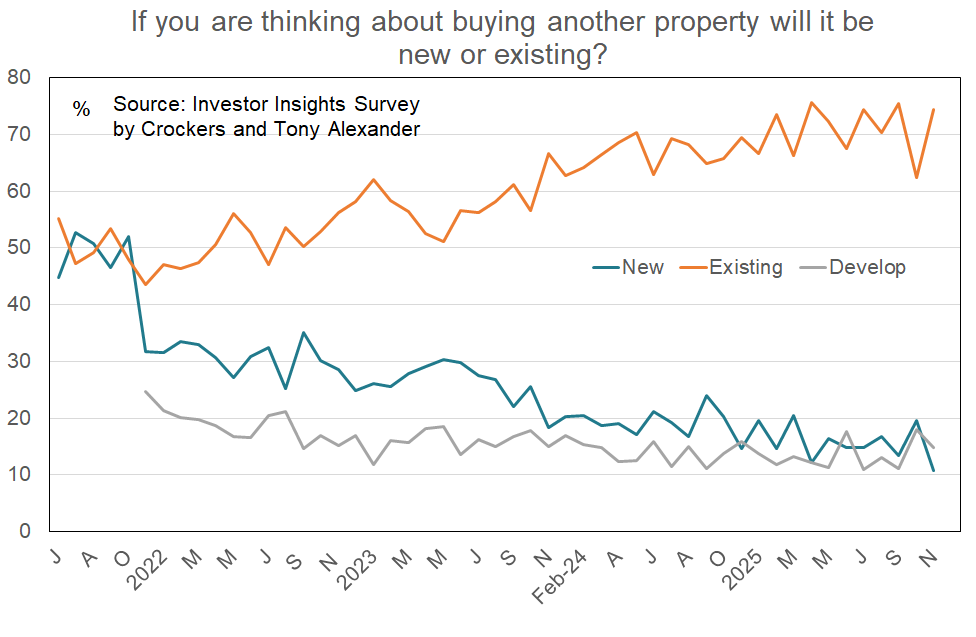

ARE YOU THINKING ABOUT BUYING ANOTHER PROPERTY WITHIN THE NEXT 12 MONTHS?

In this month’s survey only 15% of respondents have indicated that they are thinking about buying another property in the next 12 months. This is down from 18% in October and a recent peak of 22% in May.

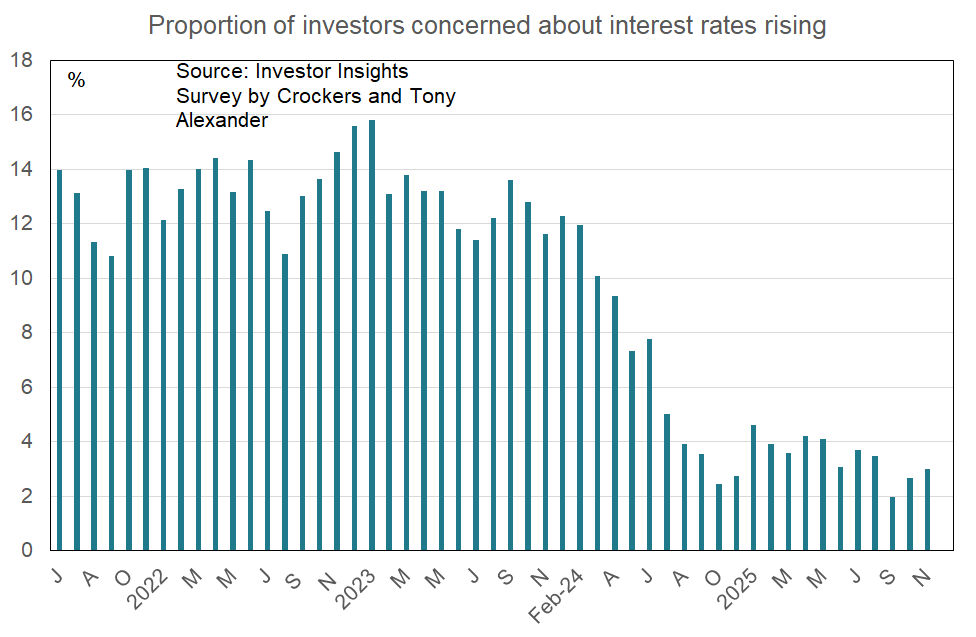

The graph suggests to us that the downward trend in buying intentions since early 2022 may remain in place despite recent signs of optimism in the economy and lower interest rates. The survey captures the period a few weeks after the Labour opposition party said they plan introducing a new capital gains tax on some properties.