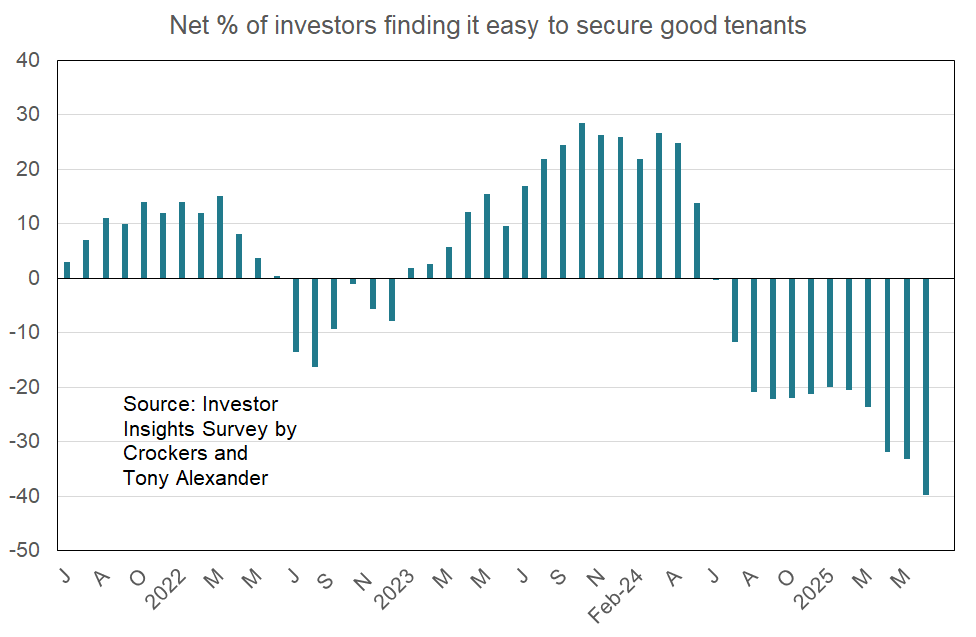

Tenants hard to find

Welcome to the latest monthly Investor Insight survey compiled by Crockers Property Management and Tony Alexander. Each month we survey a selection of the many thousands of residential property investors on our databases with a view to gauging how things are changing over time across a wide range of indicators.

For instance, we will track changes in pressures on rents, points of particular concern, and plans regarding property purchases and intentions to sell.

Key points of interest from this month’s survey, which received 246 responses include the following.

- A record net 40% of landlords say that it is difficult to get a good tenant. 14 months ago, a net 25% were saying it was easy. Market conditions have changed substantially.

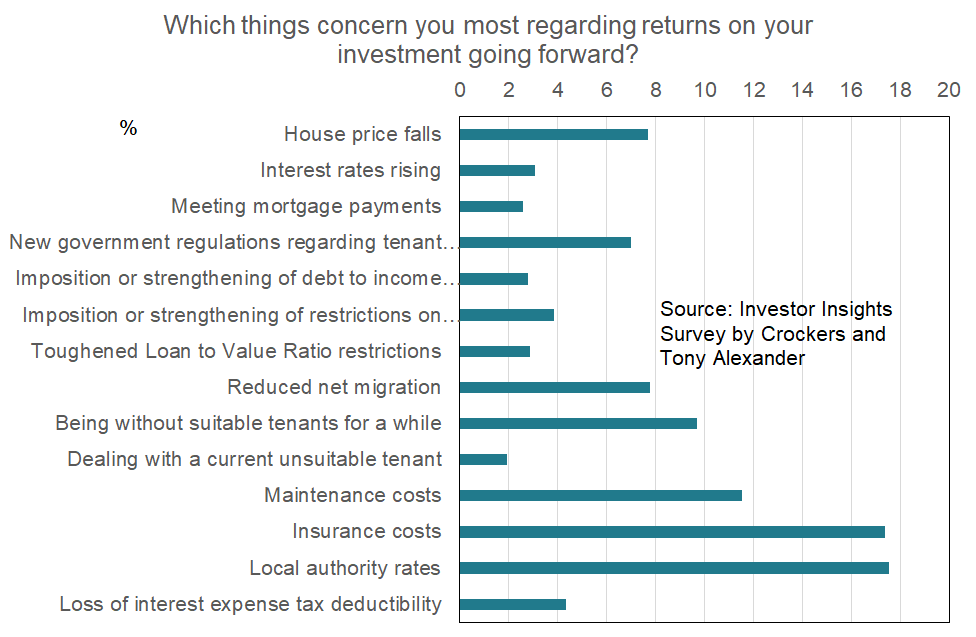

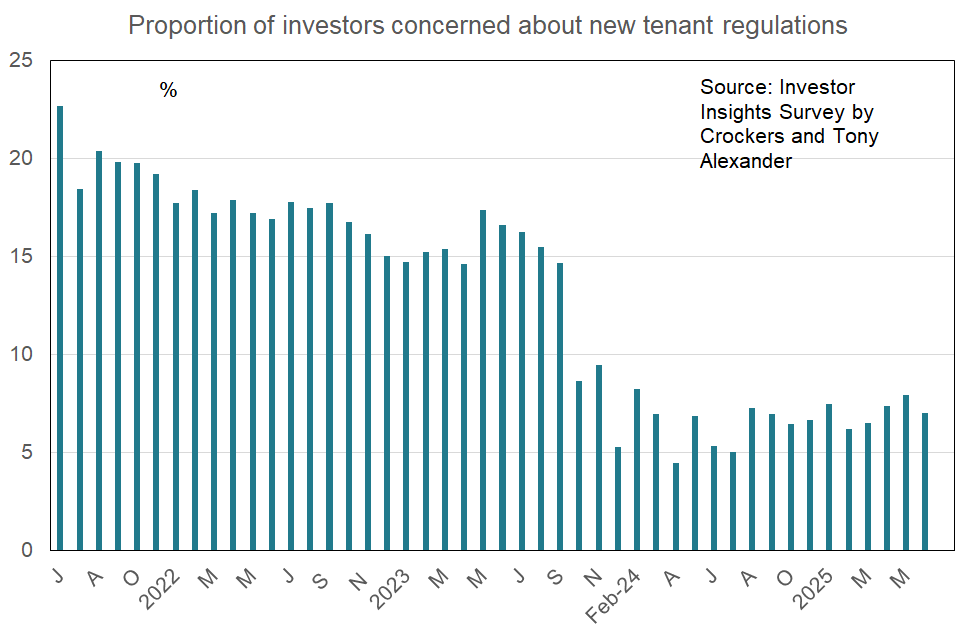

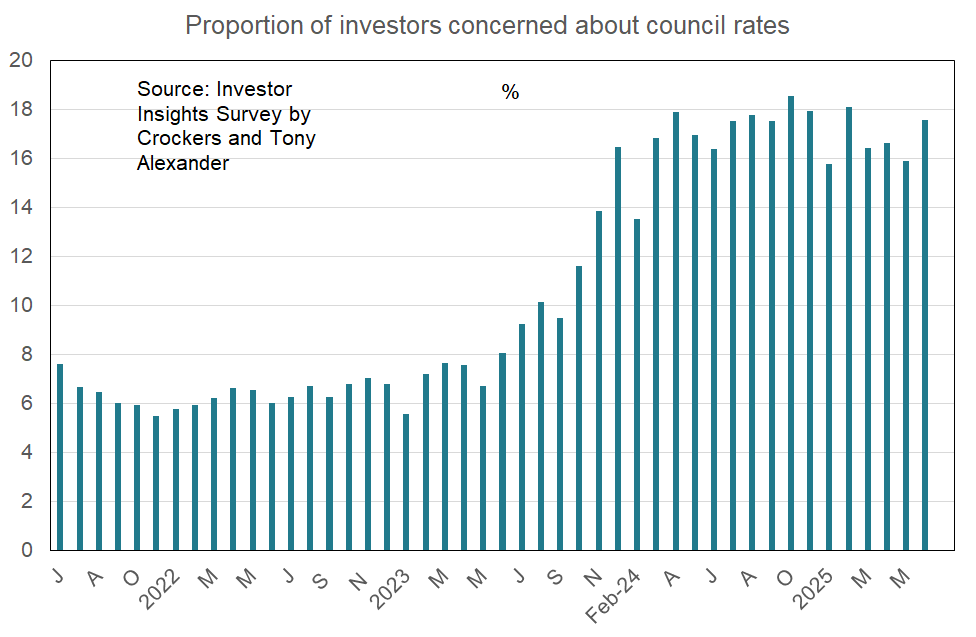

- The greatest area of concern for landlords is rising council rates.

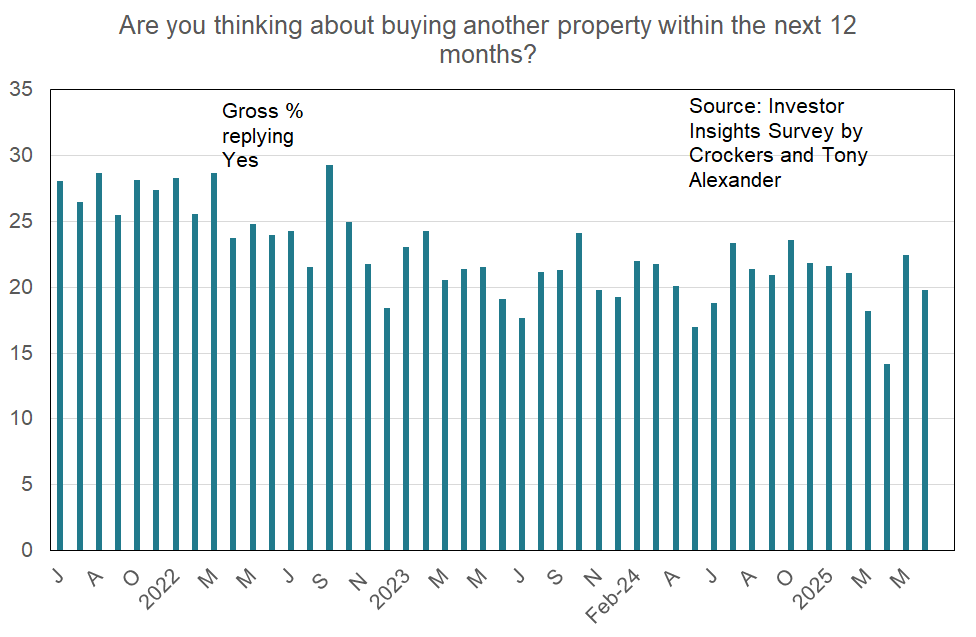

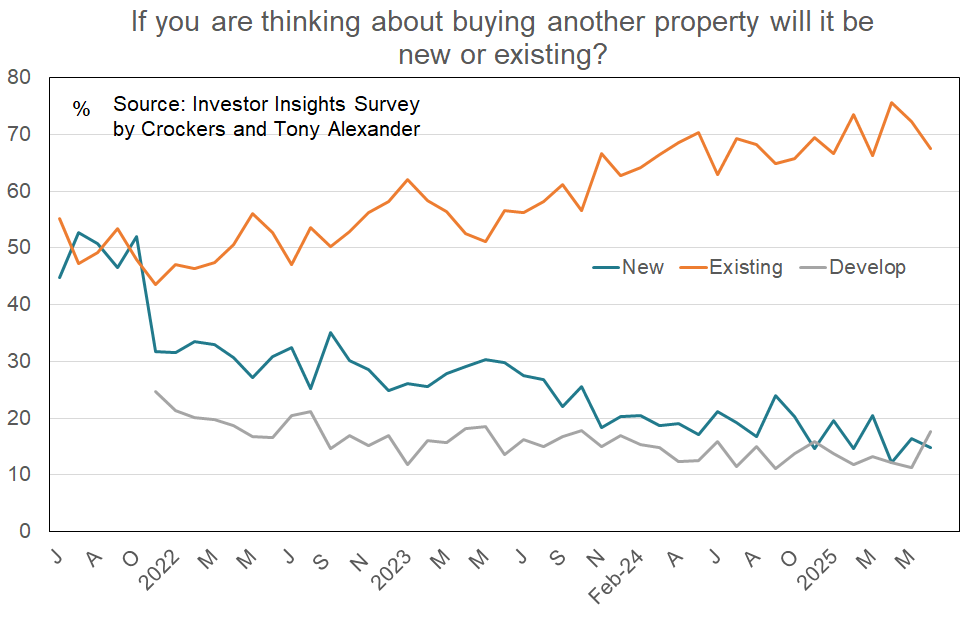

ARE YOU THINKING ABOUT BUYING ANOTHER PROPERTY WITHIN THE NEXT 12 MONTHS?

In our survey this month 20% of landlords have said that they are thinking about buying another property within the next 12 months. The graph here shows that these buying intentions eased off over the second half of 2022. But since then, buying intentions have moved in a relatively tight range with no upward or downward trend evident.