Landlords pull back on plans to raise rents

Welcome to the latest monthly Investor Insight survey compiled by Crockers Property Management and Tony Alexander. Each month we survey a selection of the many thousands of residential property investors on our databases with a view to gauging how things are changing over time across a wide range of indicators.

For instance, we will track changes in pressures on rents, points of particular concern, and plans regarding property purchases and intentions to sell.

Key points of interest from this month’s survey, which received 277 responses include the following.

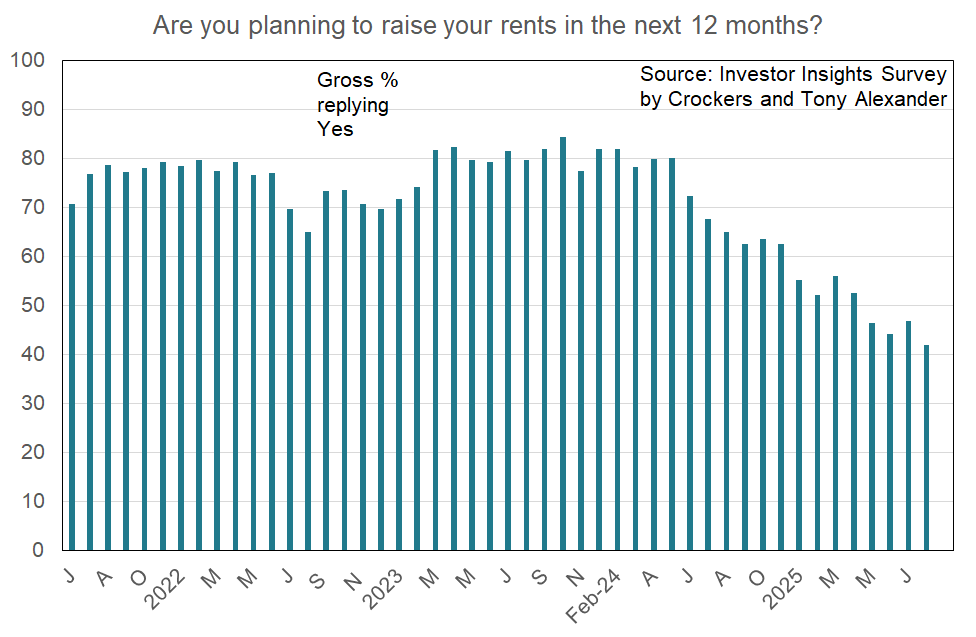

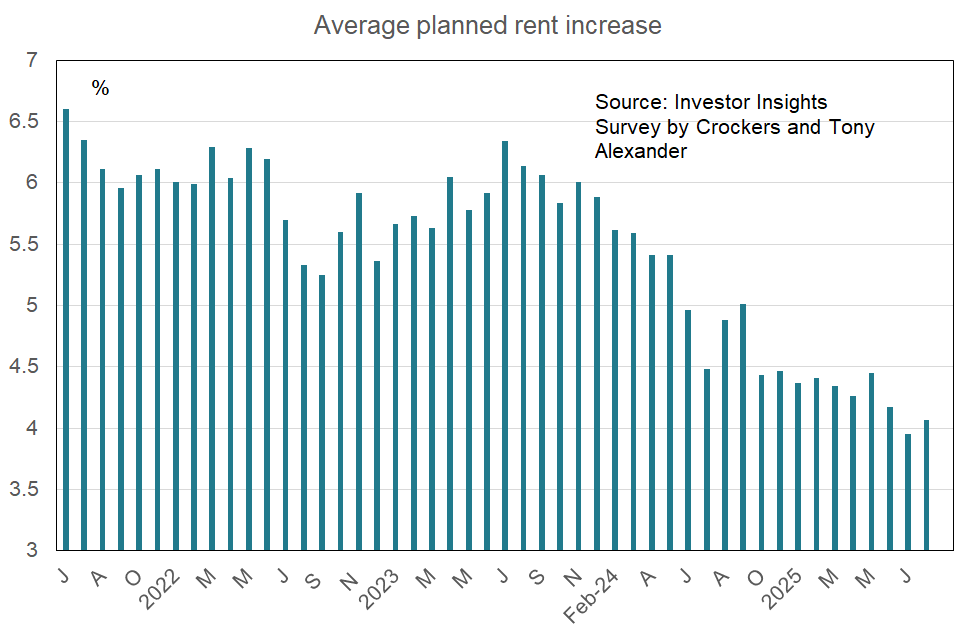

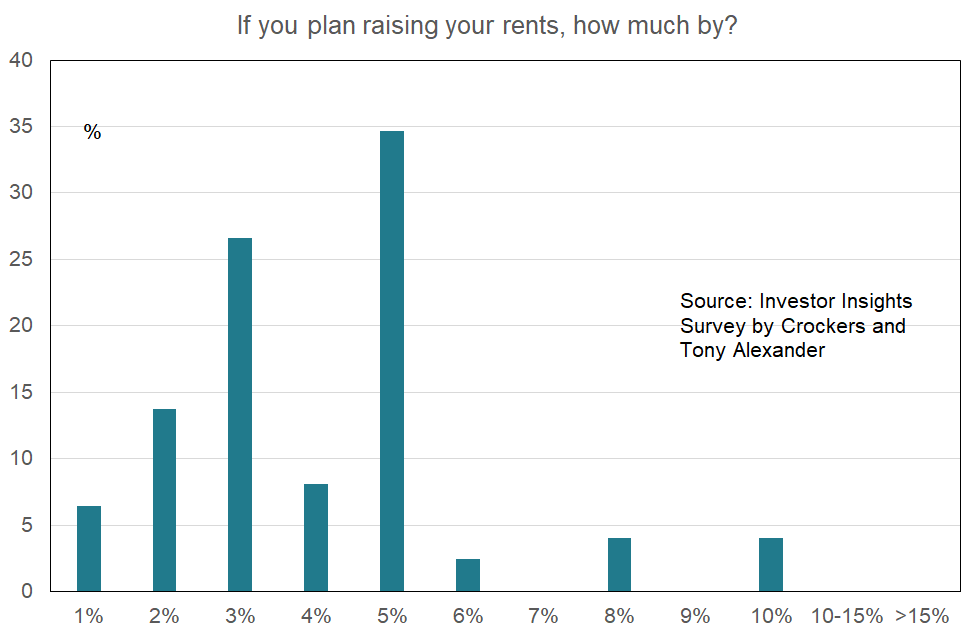

- The net proportion of landlords planning rent rises has decreased to a record low.

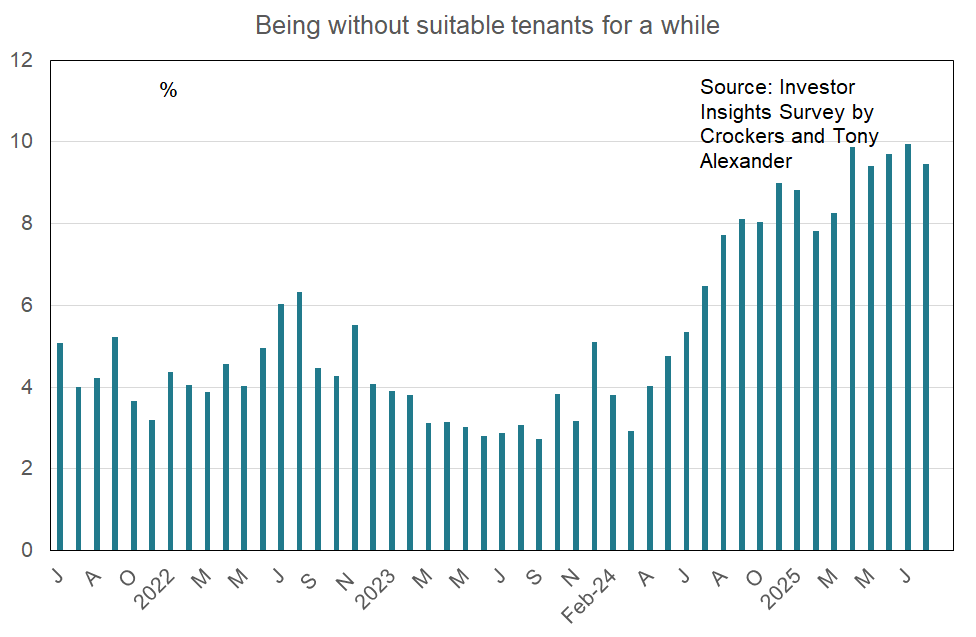

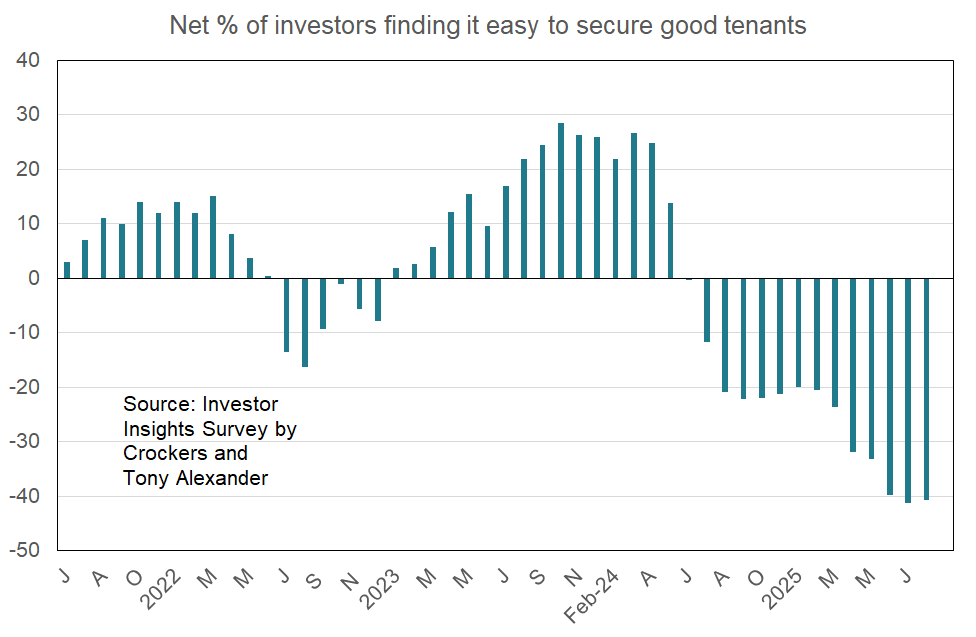

- Finding a good tenant is reported to be currently quite difficult.

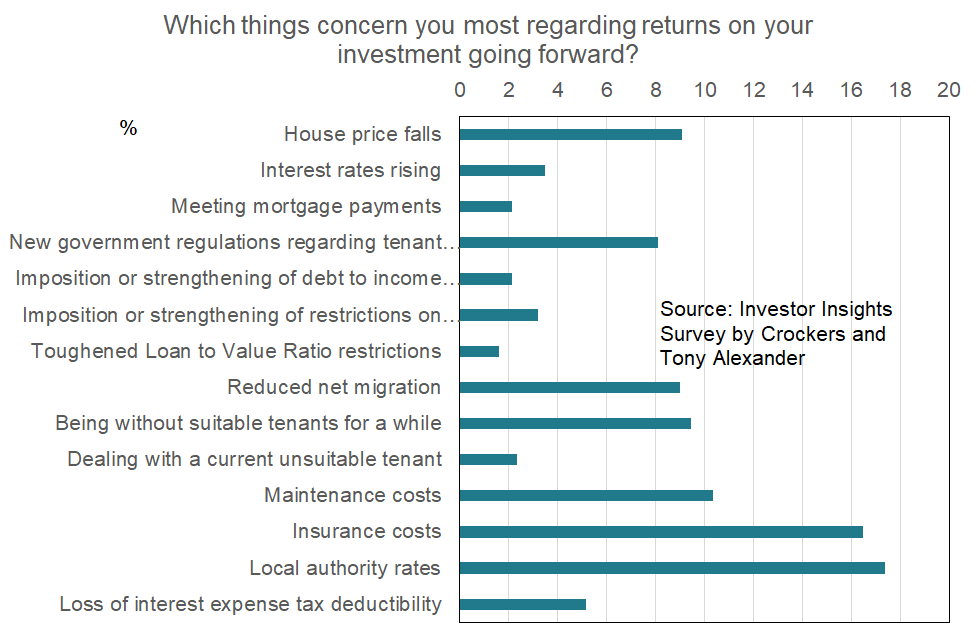

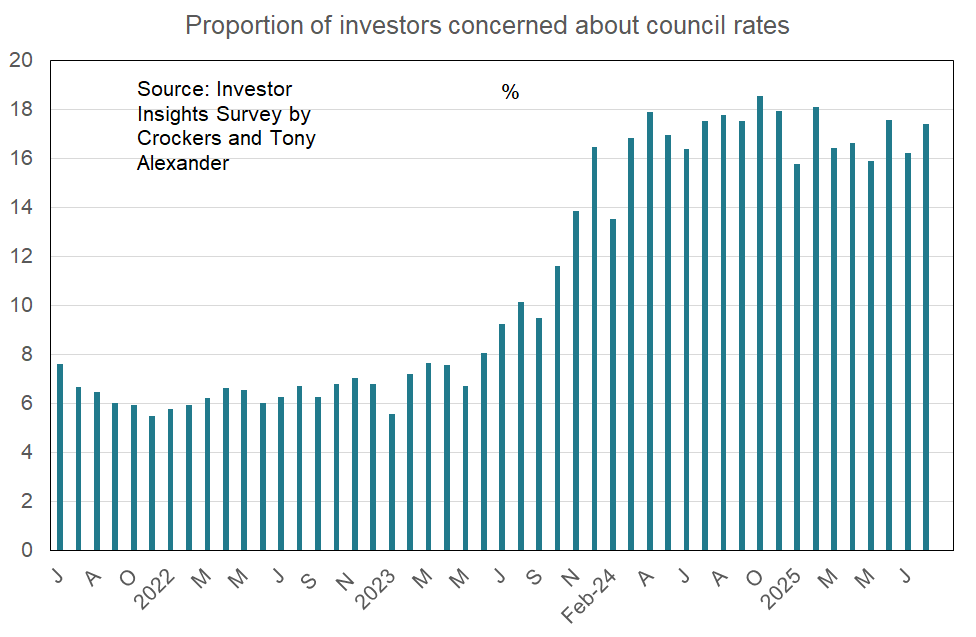

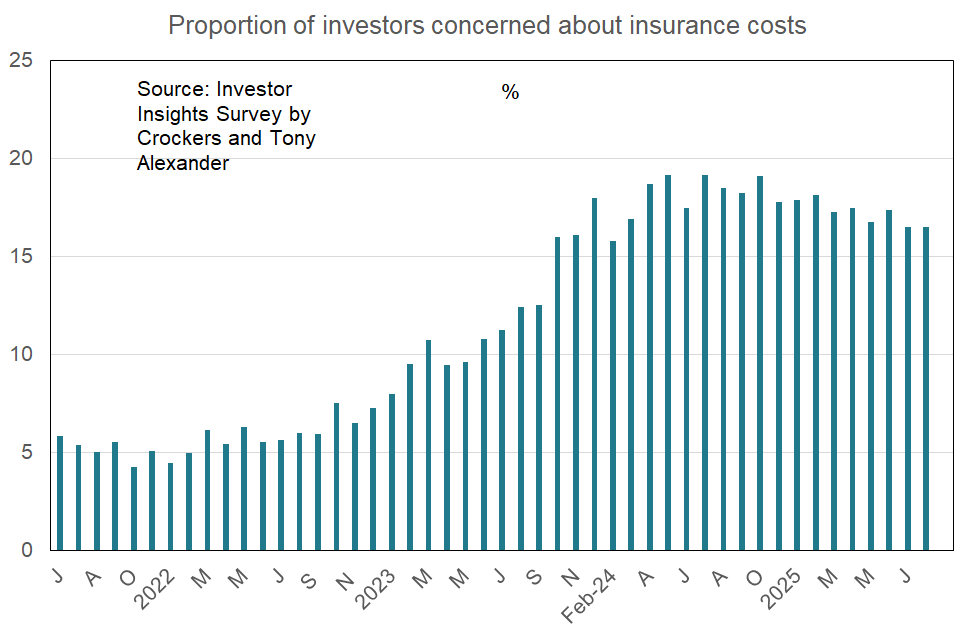

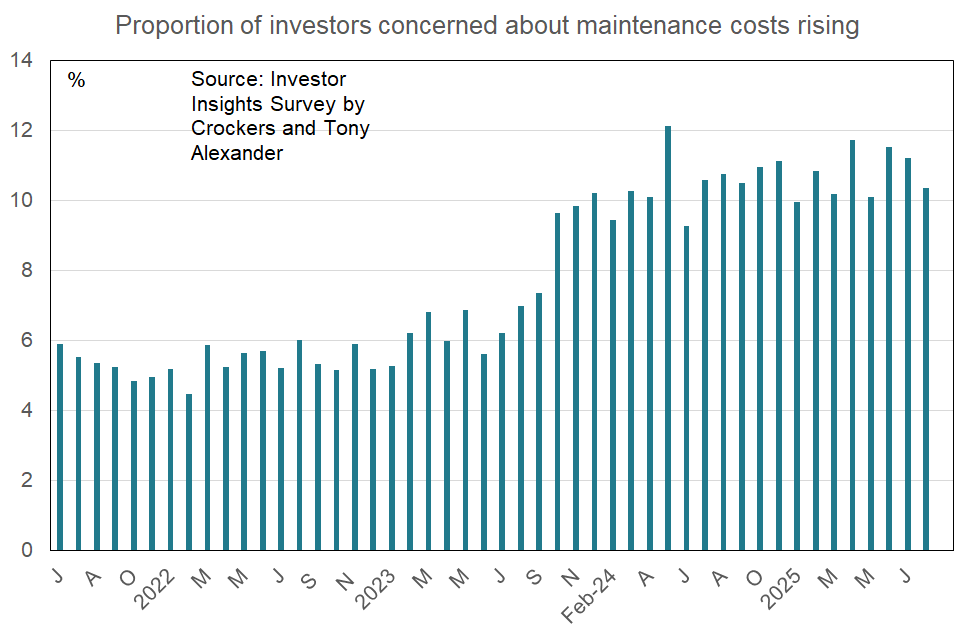

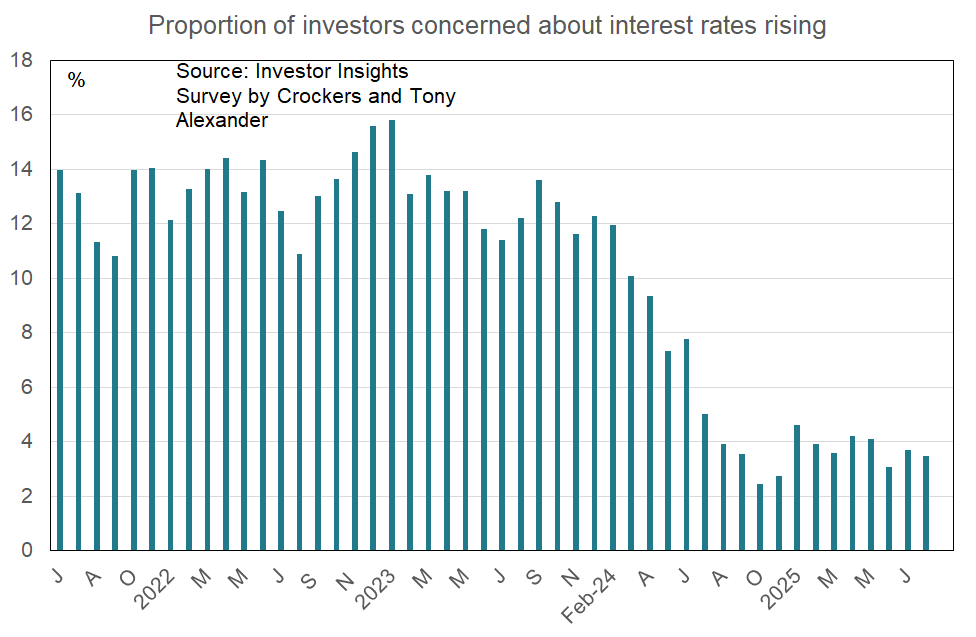

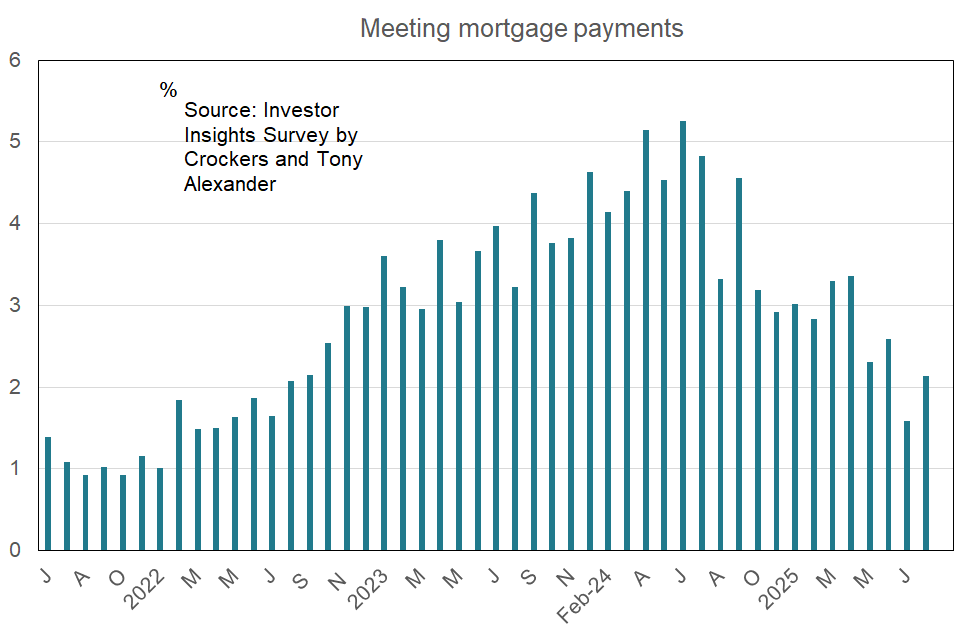

- Worries remain high about council rates rises but few landlords have concerns about meeting their mortgage repayments.

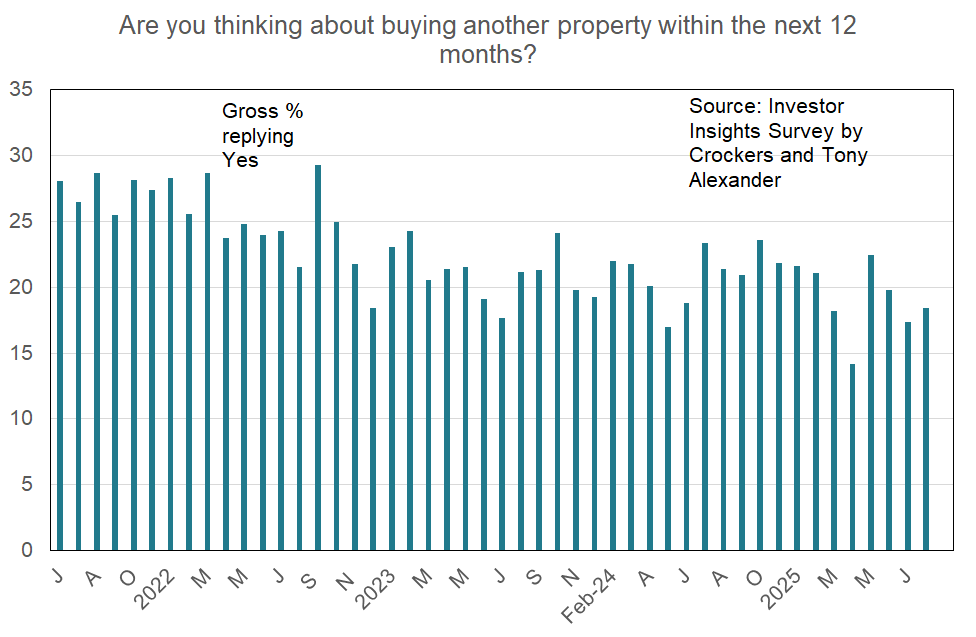

ARE YOU THINKING ABOUT BUYING ANOTHER PROPERTY WITHIN THE NEXT 12 MONTHS?

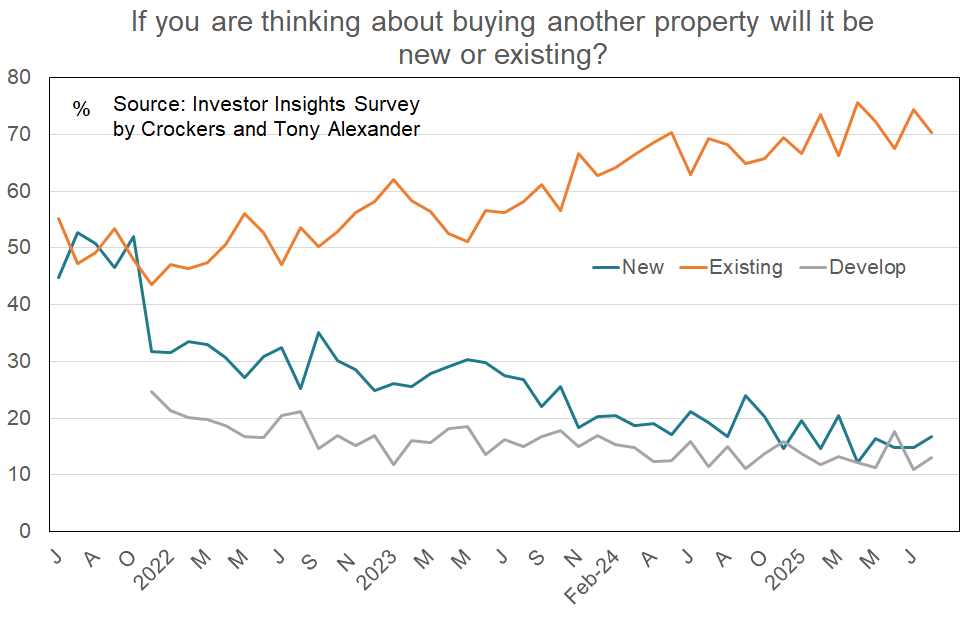

In this month’s survey 18% of landlords have reported that they are thinking about buying a property in the coming 12 months. This is towards the low end of results over the past year and tells us that for those already owning property there is no upswing in interest in making another purchase – despite what some are reporting.

The upswing may be instead from new investors not covered by our survey along with some multiple unit purchases by long-time investors acquiring property which developers with excess stock are willing to offload at a discount.